New Bank Deals Trending in the Right Direction

In the first eight months of 2020, M&A activity in the banking sector essentially ground to a halt.

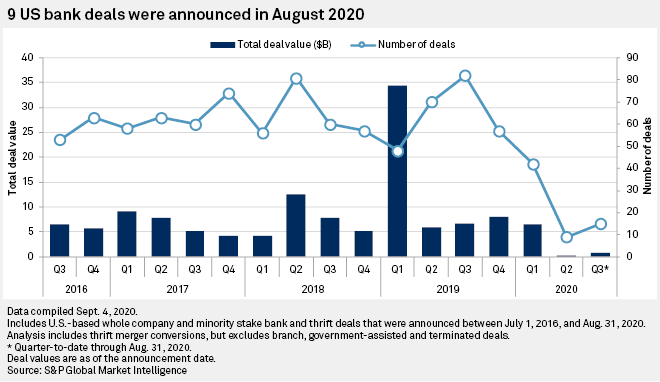

The industry saw 173 transactions worth over $45 billion take place from January to August of 2019. So far this year, however, there have only been 66 transactions valued at a total of $7.44 billion.

Considering that the last three years have generated a significantly greater number of deals (255, 254, & 257 respectively), 2020 has some catching up to do. But in all fairness, those other years didn’t have worldwide pandemics to contend with, nor did they see entire economies turned upside down.

In spite of the obstacles that this year has thrown at everyone, we are beginning to see some encouraging activity nine new deals were announced in August.

While that isn’t normally a number worth noting, it is significant in light of the dearth of activity since COVID-19 appeared. The chart below—courtesy of our friends at S&P Global—shows just how dramatic the drop has been. (The sales recorded in Q1 were actually begun in 2019, so Q2 onward is the best reflection of how COVID-19 has affected the banking industry.)

It is a tiny glimmer of light at the end of a very long tunnel, but it tells us that things are beginning to move in the right direction. Bank prices are still low (as we discussed in an earlier post), so the total deal values are less than normal. However, low prices mean that there are great deals to be had for larger banks willing to go shopping again.

Also, if you represent a bank that is looking to be the target of an acquisition, this is a great time to position yourself well by getting a few things in order. For example, in another recent post discussing community banks, we recommended taking a look at the Federal Financial Institutions Examinations Council’s (FFIEC) Statement on Pandemic Planning. Having a plan in place for this pandemic (or whatever large-scale situation your bank may be caught up in) is one way to make your institution more attractive to potential buyers.

At Southard Financial, we want to help both parties come to the table fully prepared and with total confidence that they have the best information possible. We provide fairness opinions for the deal process and provide fair value calculations of the assets purchased for post-deal accounting.

Banking M&A activity is beginning to improve. Contact us today to make sure you’re ready to take full advantage of it.

Tags: COVID-19